Calculate depreciation of laptop

Depreciation asset cost salvage value useful life of asset. Depreciation rate finder and calculator.

How To Calculate Book Value 13 Steps With Pictures Wikihow

Determine the cost of the asset.

. Assuming that the useful life for a laptop is three years the depreciation rate stands at 333. First we want to calculate the annual. While all the effort has been made to make this.

Easiest way to do this is through excel. All non-business taxpayers can claim a full deduction if the computer laptop or tablet costs no more than 300. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

The calculator should be used as a general guide only. Divide the depreciation base by the laptops useful life to calculate depreciation. Subtract the estimated salvage value of the asset from.

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. How do you calculate depreciation on a laptop. The formula to calculate.

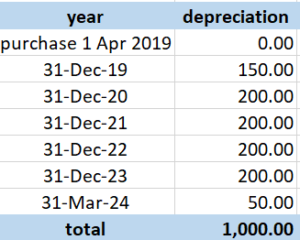

The tool includes updates to. Calculate his annual depreciation expense for the year ended 2019. In the example 520 minus 65 equals 455.

Mobileportable computers including laptop s tablets 2 years. In the example 455 divided by three years. The four most widely used depreciation formulaes are as listed below.

Find the depreciation rate for a business asset. This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. Divide the depreciation base by the laptops useful life to calculate depreciation.

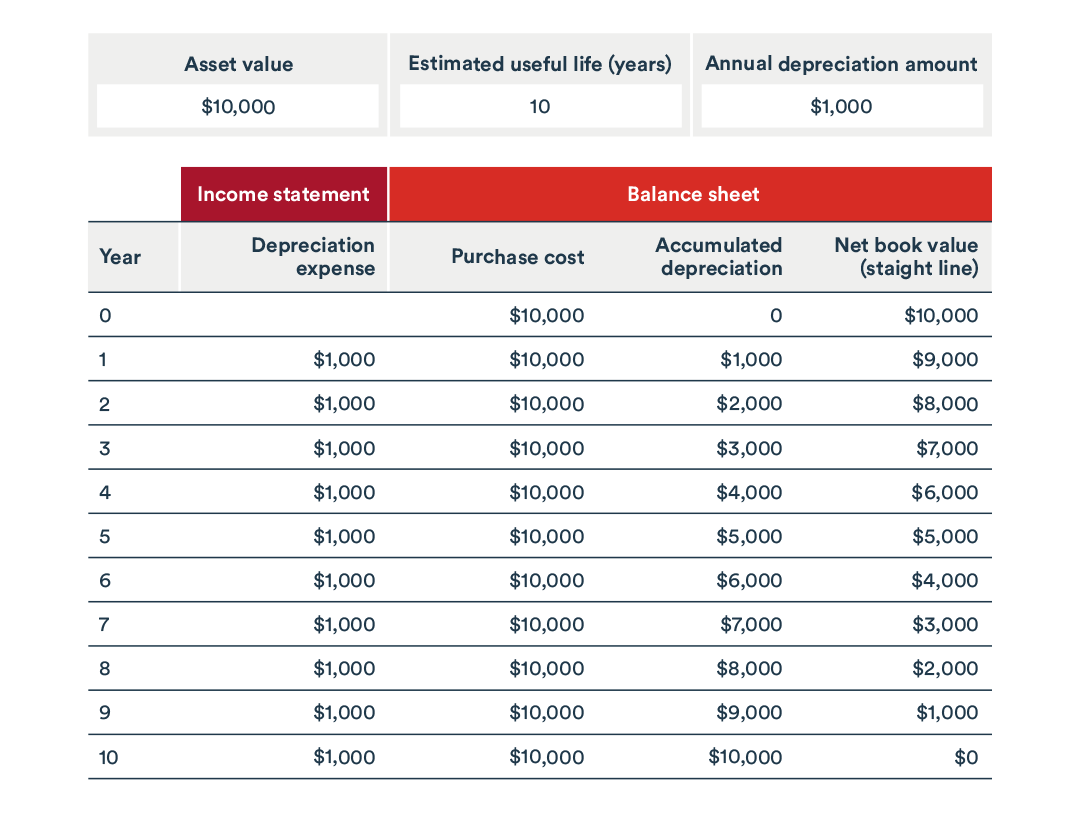

264 hours 52 cents 13728. Straight Line Depreciation Method. How to Calculate Straight Line Depreciation.

There are many variables which can affect an items life expectancy that should be taken into. You take your Historical Value and subtract the residual value to get the depreciable value. Assuming that the useful life for a laptop is three years the depreciation rate stands at 333 but not for the first and final year.

He has a policy of charging depreciation at a rate of 15 at the reducing balance method. Before you use this tool. You can use this tool to.

The straight line calculation steps are. Answer 1 of 2. Calculate depreciation for a business asset using either the diminishing value.

Where the cost is more than 300 then the depreciation. You then divide this by the estimated useful life. You can set up columns for the following Historical Value Residual Value Useful Life and Accumulated Depreciation.

ATO Depreciation Rates 2021.

Salvage Value Formula Calculator Excel Template

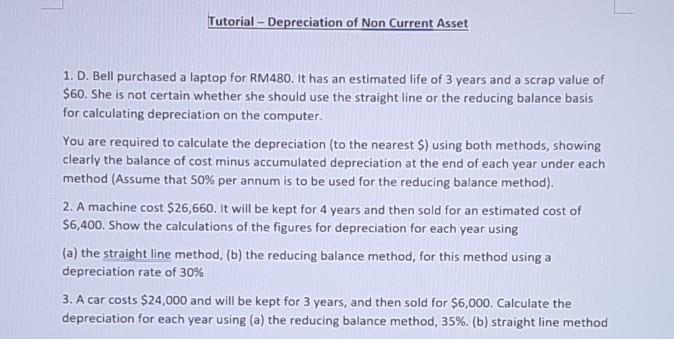

Solved Tutorial Depreciation Of Non Current Asset 1 D Chegg Com

Depreciation Rate Formula Examples How To Calculate

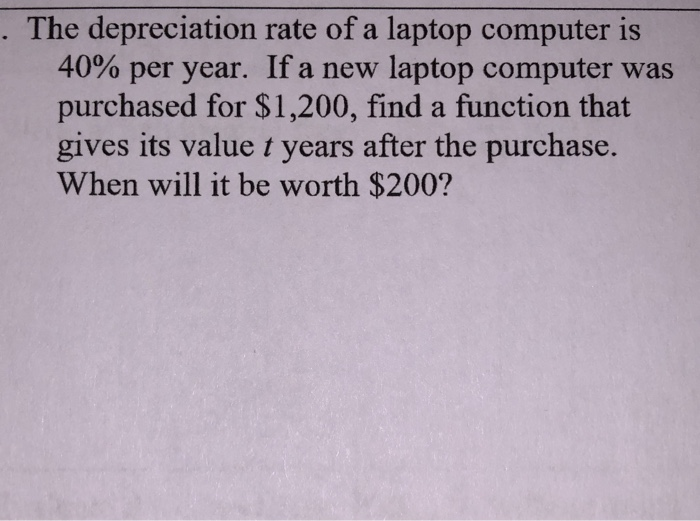

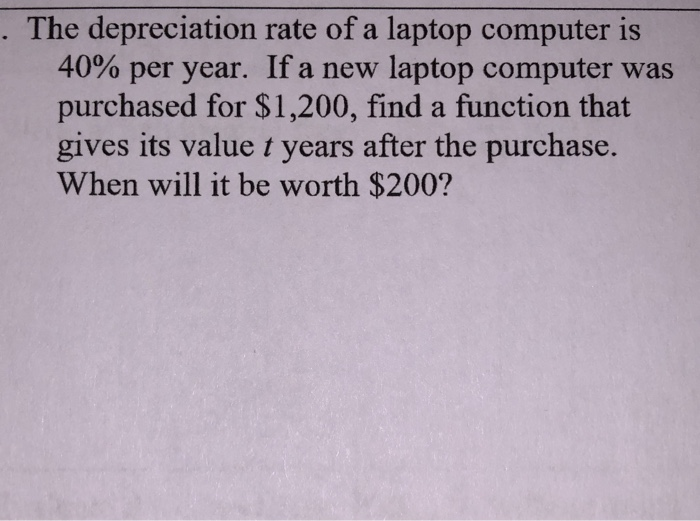

Solved The Depreciation Rate Of A Laptop Computer Is 40 Chegg Com

How To Calculate Depreciation Know Your Assets Real Value

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

What Is Amortization Bdc Ca

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Handle Tangible Fixed Assets Changing Tides

Depreciating Capital Costs Wikieducator

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Legalzoom

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Projectmanagement Com What Is Depreciation

Macrs Depreciation Calculator With Formula Nerd Counter